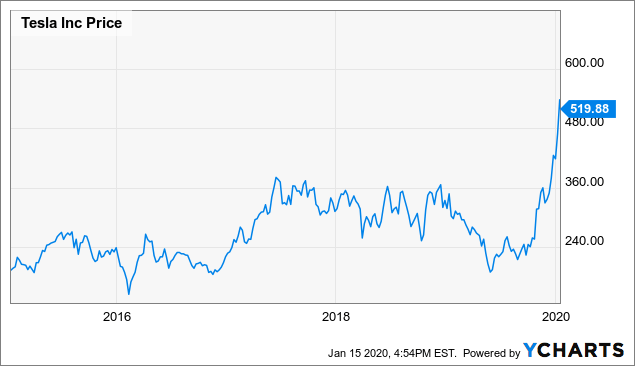

Tesla, the world’s electric vehicle maker, established a business climate good to advertise changes through effective usage of troublesome development procedure. Since the time the organization upset the car business adding a tech measurement to it, the TSLA stock price, has expanded by approximately multiple times in an incentive from its IPO in 2010 with a beginning cost of 18 for every offer to more than 500.

Net income values of tesla stock

The cost gauge increment was basically determined by the organizations extending creation capacities, improved cost the executives and solid items pipeline, which should empower it to post generally continued productivity in 2020. Leveling up to organizations, for example, Tesla has become the object of want for a large number of ventures. In any case, it is accepted that Tesla is emphatically exaggerated: it remains shortfall making with the changed total compensation remaining at – 0.6bn and – 0.4bn and EPS Earning per Share at – 2.88 and – 1.34 in 2016 and 2018 individually.

The mounting rivalry in the EV market from standard automakers, diminished deals from China and the worldwide spread of Covid in 2020 can likewise cause the TSLA stock price. Some began to bring up issues: Does the offer cost for Tesla reflect what it is truly worth? On the off chance that problematic model are, actually, something late how is it conceivable to assess whether an organization can be both troublesome and beneficial, and what might be the satisfactory limited income value dependent on the organization’s life cycle as various dangers mean particular markdown rates?

High cost of production of Tesla

The world’s first organization exclusively spent significant time being developed, plan, creation and offer of every electric vehicle. The firm additionally produces, introduces and keeps up sun based and energy sunlight based capacity frameworks. In car portion, Tesla has stepped in the development period of its business life cycle with the presentation of its new EV models; subsequently increase its income age. In any case, the organization is still at its beginning phase with moderately TSLA stock price what’s more, money consuming nature, which is commonplace for capital serious organizations.

Here is the means by which DCF is determined. The limited income model gauges an association’s endeavor an incentive by limiting its future free income to firm. Since FCFF is the money created by the organization after all working and capital costs, however before obligation administration and investor compensations, it is limited by weighted normal expense of capital of the firm. You can find the releases at https://www.webull.com/releases/nasdaq-tsla if you want to buy the stock.

Disclaimer: The analysis information is for reference only and does not constitute an investment recommendation.